RCAP Jurisdictional assessments: regulatory implementation consistency

Updated 13 December 2023

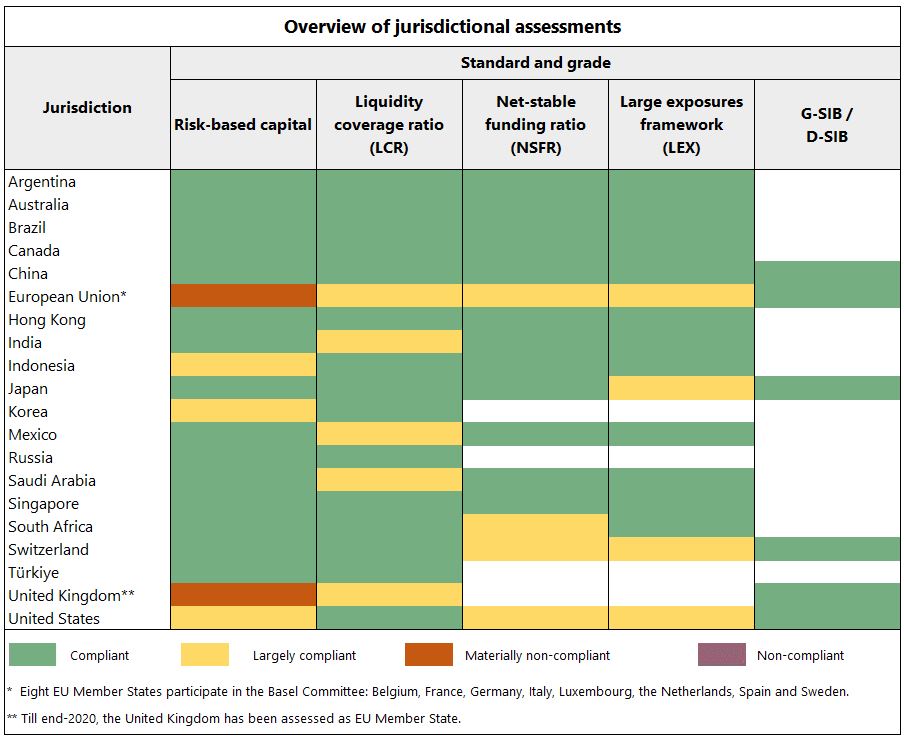

Jurisdictional assessments review the extent to which domestic regulations in each member jurisdiction are aligned with the minimum regulatory standards agreed by the Committee (more about the RCAP remit and methods). The results of each assessment are published in a separate report on the specific jurisdiction.

See also: RCAP on timeliness: Basel III implementation dashboard on the adoption of the Basel regulatory framework - a high-level view of Basel Committee members' progress in adopting Basel III regulations

28 jurisdictions covering 90% of the world's banking assets

| Argentina | Hong Kong SAR | Mexico | Switzerland |

| Australia | India | Russia | Türkiye |

| Brazil | Indonesia | Saudi Arabia | United States |

| Canada | Japan | Singapore | European Union |

| China | Korea | South Africa |

Summary of member assessments

Schedule of member assessments

Assessment of implementation of Basel III capital regulations (2012-16): all members' implementation of the risk-based capital framework has been reviewed.

Assessment of G-SIB / D-SIB requirements (2016): the implementation of all jurisdictions that were home to G-SIBs in 2016 has been reviewed.

Assessments of implementation of the Basel III liquidity regulations (2014-17): all members' implementation of the liquidity coverage ratio (LCR) has been reviewed.

Jurisdictional assessments of NSFR and LEX global standards started in 2018 and resumed in late 2021 after being suspended in March 2020 following the outbreak of Covid-19.

| Argentina | Risk based capital standards | September 2016 |

| Liquidity (LCR) | September 2016 | |

| Net Stable Funding Ratio (NSFR) | November 2019 | |

| Large exposure framework | November 2019 | |

| G-SIB / D-SIB requirements | ||

| Post RCAP follow up (self reporting) | ||

| Australia | Risk based capital standards | March 2014 |

| Liquidity (LCR) | October 2017 | |

| Net Stable Funding Ratio (NSFR) | July 2019 | |

| Large exposure framework | July 2019 | |

| G-SIB / D-SIB requirements | ||

| Post RCAP follow up (self reporting) | March 2016 March 2017 |

|

| Brazil | Risk based capital standards | December 2013 |

| Liquidity (LCR) | October 2017 | |

| Net Stable Funding Ratio (NSFR) | March 2019 | |

| Large exposure framework | March 2019 | |

| G-SIB / D-SIB requirements | ||

| Post RCAP follow up (self reporting) | March 2015 March 2016 March 2017 |

|

| Canada | Risk based capital standards | June 2014 |

| Liquidity (LCR) | October 2017 | |

| Net Stable Funding Ratio (NSFR) | July 2019 | |

| Large exposure framework | July 2019 | |

| G-SIB / D-SIB requirements | ||

| Post RCAP follow up (self reporting) | March 2016 March 2017 |

|

| China | Risk based capital standards | September 2013 |

| Liquidity (LCR) | July 2017 | |

| Net Stable Funding Ratio (NSFR) | November 2019 | |

| Large exposure framework | November 2019 | |

| G-SIB / D-SIB requirements | June 2016 | |

| Post RCAP follow up (self reporting) | March 2015 March 2016 March 2017 |

|

| European Union | Risk based capital standards | December 2014 (preliminary version, October 2012) |

| Liquidity (LCR) | July 2017 | |

| Net Stable Funding Ratio (NSFR) | July 2022 | |

| Large exposure framework | July 2022 | |

| G-SIB / D-SIB requirements | June 2016 | |

| Post RCAP follow up (self reporting) | March 2016 March 2017 |

|

| Hong Kong SAR | Risk based capital standards | March 2015 |

| Liquidity (LCR) | March 2015 | |

| Net Stable Funding Ratio (NSFR) | March 2020 | |

| Large exposure framework | March 2020 | |

| G-SIB / D-SIB requirements | ||

| Post RCAP follow up (self reporting) | March 2017 |

|

| India | Risk based capital standards | June 2015 |

| Liquidity (LCR) | June 2015 | |

| Net Stable Funding Ratio (NSFR) | July 2019 | |

| Large exposure framework | July 2019 | |

| G-SIB / D-SIB requirements | ||

| Post RCAP follow up (self reporting) | March 2017 |

|

| Indonesia | Risk based capital standards | December 2016 |

| Liquidity (LCR) | December 2016 | |

| Net Stable Funding Ratio (NSFR) | March 2020 | |

| Large exposure framework | March 2020 | |

| G-SIB / D-SIB requirements | ||

| Post RCAP follow up (self reporting) | March 2017 |

|

| Japan | Risk based capital standards | October 2012 December 2016 (follow-up assessment) |

| Liquidity (LCR) | December 2016 | |

| Net Stable Funding Ratio (NSFR) | September 2022 | |

| Large exposure framework | September 2022 | |

| G-SIB / D-SIB requirements | June 2016 | |

| Post RCAP follow up (self reporting) | March 2015 March 2016 March 2017 |

|

| Korea | Risk based capital standards | September 2016 |

| Liquidity (LCR) | September 2016 | |

| Net Stable Funding Ratio (NSFR) | ||

| Large exposure framework | ||

| G-SIB / D-SIB requirements | ||

| Post RCAP follow up (self reporting) | ||

| Mexico | Risk based capital standards | March 2015 |

| Liquidity (LCR) |

March 2015 |

|

| Net Stable Funding Ratio (NSFR) | December 2023 | |

| Large exposure framework | December 2023 | |

| G-SIB / D-SIB requirements | ||

| Post RCAP follow up (self reporting) | March 2017 |

|

| Russia | Risk based capital standards | March 2016 |

| Liquidity (LCR) | ||

| Net Stable Funding Ratio (NSFR) | ||

| Large exposure framework | ||

| G-SIB / D-SIB requirements | ||

| Post RCAP follow up (self reporting) | ||

| Saudi Arabia | Risk based capital standards | September 2015 |

| Liquidity (LCR) | September 2015 | |

| Net Stable Funding Ratio (NSFR) | September 2018 | |

| Large exposure framework | September 2018 | |

| G-SIB / D-SIB requirements | ||

| Post RCAP follow up (self reporting) | March 2017 |

|

| Singapore | Risk based capital standards | March 2013 |

| Liquidity (LCR) | December 2016 | |

| Net Stable Funding Ratio (NSFR) | March 2020 | |

| Large exposure framework | March 2020 | |

| G-SIB / D-SIB requirements | ||

| Post RCAP follow up (self reporting) | March 2015 March 2016 March 2017 |

|

| South Africa | Risk based capital standards | June 2015 |

| Liquidity (LCR) | June 2015 | |

| Net Stable Funding Ratio (NSFR) | April 2023 | |

| Large exposure framework | April 2023 | |

| G-SIB / D-SIB requirements | ||

| Post RCAP follow up (self reporting) | March 2017 |

|

| Switzerland | Risk based capital standards | June 2013 |

| Liquidity (LCR) | October 2017 | |

| Net Stable Funding Ratio (NSFR) | December 2023 | |

| Large exposure framework | December 2023 | |

| G-SIB / D-SIB requirements | June 2016 | |

| Post RCAP follow up (self reporting) | March 2015 March 2016 March 2017 |

|

| Türkiye | Risk based capital standards | March 2016 |

| Liquidity (LCR) | March 2016 | |

| Net Stable Funding Ratio (NSFR) | ||

| Large exposure framework | ||

| G-SIB / D-SIB requirements | ||

| Post RCAP follow up (self reporting) | ||

| United States | Risk based capital standards | December 2014 (preliminary version, October 2012) |

| Liquidity (LCR) | July 2017 | |

| Net Stable Funding Ratio (NSFR) | July 2023 | |

| Large exposure framework | July 2023 | |

| G-SIB / D-SIB requirements | June 2016 | |

| Post RCAP follow up (self reporting) | March 2016 March 2017 |